NEC Technologies India (NECTI), a wholly owned subsidiary of Japanese firm NEC Corporation, and CSC e-Governance Services India (CSC SPV) announced a strategic alliance to jointly develop and deliver new digital services to approximately 900 million citizens living in rural areas of India.

As part of this alliance, NECTI has decided to do an equity investment in CSC SPV to become the third-biggest shareholder. NEC and CSC SPV also created a joint-working group within CSC SPV to develop new, innovative digital services for citizens living in rural areas of India.

With more than 470,000 transactions occurring at CSCs across India every day, CSC will be able to launch, refine and tweak the variety and efficiency of services on offer by leveraging NEC's expertise in areas such as AI and data analytics.

These AI and data analytics-driven initiatives will improve service experience across various sectors, including finance, education and healthcare, among others.

Takayuki Inaba, Managing Director, NEC Technologies India, said, “As a leading provider of ICT solutions, we are delighted to extend our involvement with CSC SPV to digitally empower residents in rural areas. With this strategic alliance, our innovative technologies will unlock new opportunities and bring additional value to citizens, CSC operators as well as CSC SPV.”

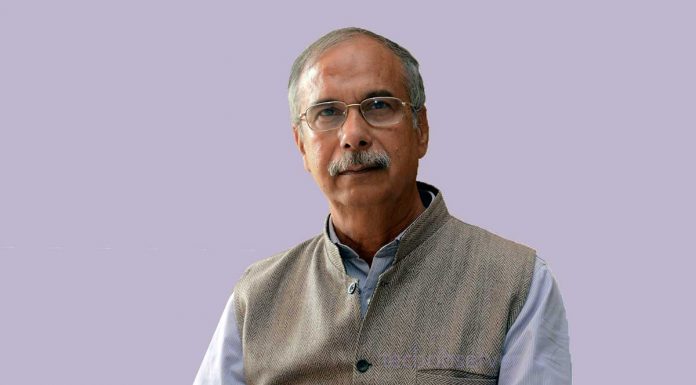

“The association with NECTI will help in utilising technologies for delivery of various services to citizens, especially those living in rural India. Education, financial inclusion and telemedicine are the areas where innovative technologies can be utilised to improve the quality of life for people living in rural India,” said Dr. Dinesh Kumar Tyagi, CEO, CSC SPV.

NECTI and CSC SPV had previously worked together with leading Indian banks to provide financial inclusion services for residents who are out of coverage from traditional bank branches and ATMs.

Launched back in 2017, this financial inclusion service allows users to perform bank transactions, including receiving subsidies from the government, by verifying their identity through biometric scans at CSCs across the country without having to travel to a distant bank branch.