Tesla has many unique values that bode well for its future as a company. Tesla is at the forefront of producing and delivering electric vehicles, more or less signalling the end of the conventional automotive industry. Additionally, Tesla has concentrated on bolstering its artificial intelligence features, including advanced autopilot and self-driving cars.

Compared to other automotive companies, Tesla weathered the supply chain disruption better because it is more vertically integrated and less reliant on manufacturers for its auto parts. Finally, Tesla has plans to significantly increase its deliveries of electric vehicles in the next ten years. With advancements in these areas, Tesla's stock price could likely continue to gain attention in the markets, attracting the interest of those involved in online trading of CFDs.

Tesla Delivered Despite Setbacks

Despite supply chain disruptions that wreaked havoc on the automotive industry, Tesla presented strong deliveries growth in the third quarter of 2021. Tesla deliveries soared up 87% in 2021, while rivals' deliveries plunged due to supply chain issues.

During this challenging time, Tesla's tactics for managing consisted of removing features such as radar sensors and lumbar support from passenger seats to make cars less complicated to build. Additionally, Tesla increased the prices of its vehicles to compensate for the higher production costs faced by the company. For instance, customers, who waited seven years for the Model Y paid 18% more than the previous year for the car. Given how Tesla weathered these significant issues, Tesla remains one to watch for online trading of share prices.

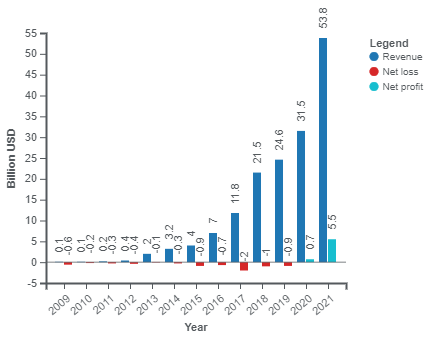

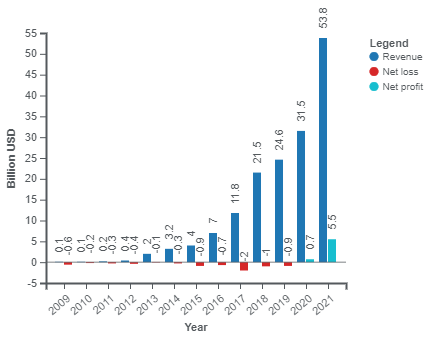

Tesla's financial performance

Tesla's Unique Value Compared to Other Automakers

The key to Tesla's success is that it is more vertically integrated than its competitors. Understanding the complex supply chain of the automotive industry, Tesla vertically integrated many steps in production such as battery production, electric motor production, and self-driving algorithms. This process has granted Tesla far more control over the process and less reliance on suppliers, generating more efficiency in the production process. Tesla's vertical integration techniques place it a step ahead of competing carmakers.

Tesla's Future Growth Prospects

In addition to its growth in the electric vehicles industry, Tesla's advanced autopilot and full self-driving (FSD) features will continue to give it an edge against its competition. Although several automaking companies are creating FSD vehicles, Tesla attracts top talent. Tesla is also expanding its FSD beta testing to more drivers to streamline rollout and test its FSD functionality.

However, the new technology does not come without setbacks. Tesla just recalled all 53,822 vehicles with its FSD feature because it was said to roll through stop signs in some scenarios intentionally. This month, Tesla decided to disable the FSD function since the feature has been inconsistent and still requires an attentive driver.

Furthermore, Tesla plans to roll out solar deployments and energy storage products in the future, which are solid growth prospects for the company.

Tesla's Future Growth Plans

Tesla stated that it plans to grow its electric vehicle deliveries at an average annual rate of 50% over a multi-year horizon. This rate extrapolated shows Tesla producing 28 million electric vehicles 10 years from now, close to three times the number of cars that Toyota motors sold in total in 2021. Even if this rate slows down, Tesla could be selling 9.5 million electric vehicles in 2030.

Tesla is opening gigafactories in Texas and Berlin, which can increase vehicle production capacity so that the company can achieve this goal. The company also has plans to open two more gigafactories aside from those two. Additionally, the company is planning to launch its new Cybertruck. These new developments can facilitate Tesla's long-term growth and generate its success among its competitors in years to come.

Bottom Line

For several reasons, Tesla is a good company to keep an eye on from an online trading perspective over the long term. Tesla's stock price has continued to move higher as it has a competitive edge over other automotive companies, however, it has also experienced a fair share of volatility.

First, Tesla is unique among its competitors because it is more vertically integrated. This scenario allowed the company to better weather the global supply chain issues caused by chip shortages that ravaged the automotive industry. During the crisis, Tesla was also strategic in cutting back on parts in cars that were too costly, which helped it profit during this difficult time.

Second, Tesla is in the process of coming out with vital new developments that set it apart: fully autonomous vehicles and autopilot systems. Third, Tesla has growth plans to deliver significantly more electric cars in the next ten years, which it plans to achieve through opening several new gigafactories. Those with an eye on CFD trading of Tesla share prices should keep an eye on its ongoing market performance, as well as monitor any tech news involving the EV titan, in order to make more informed trading decisions.